ลงทุนได้ครบทุกสินทรัพย์

ลงทุนในบริษัทชั้นนำของไทยที่จดทะเบียนในตลาดหลักทรัพย์แห่งประเทศไทย (SET) และตลาดเอ็มเอไอ (mai) ไม่มีค่าธรรมเนียมขั้นต่ำในการเทรด

เป็นเจ้าของบริษัทชั้นนำระดับโลกกว่า 10,000 บริษัท กว่า 23 ประเทศ 31 ตลาดทั่วโลก ทั้งสหรัฐฯ ฮ่องกง โซนยุโรป เอเชีย และแคนาดา ไม่ว่าจะเป็น Facebook, Amazon, Google, Microsoft, Nvidia, LVMH, Nestle และอีกมากมาย

ครบทุกกองทุนรวม มีให้เลือกกว่า 1,800 กองทุน จาก 21 บลจ. ให้เงินงอกเงย เลือกลงทุนลดหย่อนภาษีกับกองทุน SSF RMF ได้หลากหลาย ทั้งกองทุนผสม และกองทุนตราสารหนี้

ลงทุนได้โดยตรงกับบลจ. ชั้นนำระดับโลก กระจายความเสี่ยงเพื่อเพิ่มโอกาสรับผลตอบแทนจากการลงทุน

ลงทุนในสินทรัพย์ดิจิทัลคุณภาพ ที่ได้รับใบอนุญาตประกอบธุรกิจนายหน้าและศูนย์ซื้อขายสินทรัพย์ดิจิทัลและโทเคน บนแพลตฟอร์มที่มีระบบความปลอดภัยสูงสุด (Bank Grade Security) ให้คุณมั่นใจทุกการลงทุน

ลงทุนง่ายๆ เสมือนมีผู้เชี่ยวชาญด้านการลงทุนแนะนำส่วนตัว พร้อมเทคโนโลยี อัจฉริยะช่วยบริหารและปรับพอร์ตการลงทุนให้อัตโนมัติ เริ่มต้นเพียง 5,000 บาท

บทวิเคราะห์และกลยุทธ์การลงทุน

อัพเดททุกวันกับมุมมอง และกลยุทธ์แบบเจาะลึกส่งตรงถึงคุณจากทีมนักวิเคราะห์การลงทุน

ติดตามข้อมูลข่าวสารที่เกี่ยวกับการลงทุนรอบโลก ให้คุณลงทุนทุกสินทรัพย์ได้อย่างมั่นใจ ไม่พลาดทุกจังหวะในการลงทุน

- Earnings Brief: Offshore (powered by AI)

- Offshore Stock Update

- บทวิเคราะหุ้นไทยรายบริษัท

- บทวิเคราะหุ้นไทยรายอุตสาหกรรม

- Economics Notes

- Investment Strategy

InnovestX Channel

Learning from basic to advanced level.

- {{Categories.Title}}

Knowledge HUB

แหล่งความรู้ด้านการลงทุน

มือใหม่เริ่มลงทุน

หุ้น

กองทุน

สินทรัพย์ดิจิทัล

Investment Mindset

ลงทุนเพิ่มความมั่งคั่ง

จัดพอร์ตลงทุน

News & Updates

บล. อินโนเวสท์ เอกซ์ เรือธงด้านการลงทุนภายใต้กลุ่มเอสซีบี เอกซ์ (SCBX Group) ประเมินว่าช่วงเวลาที่ยากที่สุดในรอบปีกำลังจะผ่านไปในช่วงไตรมาส 1/67 โดยประเมินว่า ตลาดหุ้นไทยจะเริ่มดีขึ้นในช่วงไตรมาสที่ 2/67 และดีขึ้นตามลำดับในครึ่งหลังปี 2567 ตามที่เคยประเมินไว้ช่วงต้นปีนี้ จากโอกาสในการดำเนินนโยบายผ่อนคลายทางการเงินของประเทศเศรษฐกิจหลัก เช่น สหรัฐฯ รวมถึง การเบิกจ่ายงบประมาณของไทยที่อยู่ระหว่างการพิจารณา ซึ่งหากการเบิกจ่ายทำได้ดีและมีประสิทธิภาพ เราประมาณการเติบโต GDP ของไทย จะขยายตัวได้ 3.0% จากการลงทุนภาครัฐและเอกชนที่เพิ่มขึ้น แต่หากการเบิกจ่ายต่ำกว่าคาด เศรษฐกิจไทยจะขยายตัวได้ 2.5% ซึ่งหากเป็นกรณีหลังประเมินว่า ธปท. อาจสามารถปรับลดดอกเบี้ยได้ 2 ครั้ง ประเมินเป้าหมาย SET Index อยู่ที่ 1,550 จุด ชี้เป้าหุ้นเด่นไตรมาส 2 เน้นโฟกัสหุ้นที่ผลประกอบการทำจุดต่ำสุดแล้วและได้ประโยชน์จากการลดดอกเบี้ย ได้แก่ AOT GFPT GULF KCE และ SCGP

บริษัทหลักทรัพย์ อินโนเวสท์ เอกซ์ จำกัด (InnovestX Securities Co., Ltd.) เรือธงด้าน การลงทุนภายใต้ กลุ่มเอสซีบี เอกซ์ (SCBX Group) เดินหน้ายกระดับผลิตภัณฑ์ และขยายบริการ ด้านการเงินการลงทุนแบบครบวงจร อย่างไม่หยุดยั้ง ด้วยความมุ่งหวังให้คนไทยสามารถเข้าถึง การลงทุนได้อย่างเท่าเทียม ล่าสุด เปิดตัว “InnovestX Wealth Solution” โซลูชันด้านการลงทุน รูปแบบใหม่ที่ช่วยให้การลงทุนมีประสิทธิภาพมากยิ่งขึ้น ชู 3 จุดเด่น 1. คัดกองทุนเด็ด ที่ดีให้ นักลงทุนแบบเป็นกลาง จากทุก บลจ. กว่า 1,800 กองทุน 2. คัดคำแนะนำการลงทุน ที่ตอบโจทย์ ความต้องการของลูกค้าแต่ละกลุ่ม และเหมาะกับสภาวะตลาดในแต่ละช่วงเวลา และ 3. คัดของดี ราคาคุ้ม สิทธิพิเศษที่เหนือกว่า โดยนำร่องผลิตภัณฑ์กองทุนเป็นสินทรัพย์แรก ก่อนขยายสู่สินทรัพย์ อื่นๆ ในอนาคต พร้อมร่วมกับ SCBAM ส่งดีลสุดเอ็กซ์คลูซีฟ ฟรี ค่าธรรมเนียมเมื่อซื้อกองทุน (Front-end Fee) กับ SCBAM ผ่าน InnovestX ตั้งแต่วันนี้ – 31 มีนาคม 2567

บริษัทหลักทรัพย์ อินโนเวสท์ เอกซ์ จำกัด (InnovestX Securities Co., Ltd.) เรือธงด้านการลงทุนภายใต้กลุ่มเอสซีบี เอกซ์ (SCBX Group) ประกาศความสำเร็จคว้า 2 รางวัล ได้แก่ นายหน้าซื้อ ขายหลักทรัพย์ยอดเยี่ยม (Best Stock Broker 2023) จาก TradingView แพลตฟอร์มระดับโลก ผู้ให้ บริการแพลตฟอร์มการสร้างและวิเคราะห์กราฟทางเทคนิค ที่มีผู้ใช้กว่า 1.4 ล้านรายในประเทศไทยและ กว่า 50 ล้านรายทั่วโลกที่โหวตโดยนักลงทุนผู้ใช้งานจริงของแต่ละโบรกเกอร์ทั่วโลก และรางวัล องค์กรยอดเยี่ยมด้านการเปลี่ยนผ่าน (Corporate Transformation 2023) สาขา Corporate Awards จาก เวที ‘Future Trends Ahead & Awards 2024’ ซึ่งจัดโดย Future Trends สื่อผู้ให้บริการข้อมูลข่าวสาร ด้านเทคโนโลยีการตลาดและนวัตกรรมชั้นนำของประเทศไทย ตอกย้ำบทบาทการเป็นบริษัทหลักทรัพย์ชั้นนำของเมืองไทยที่สามารถตอบสนองความต้องการให้กับนักลงทุนทุกกลุ่มอย่างครบวงจร

Promotion

Your Trusted Investment and Digital Services Platform

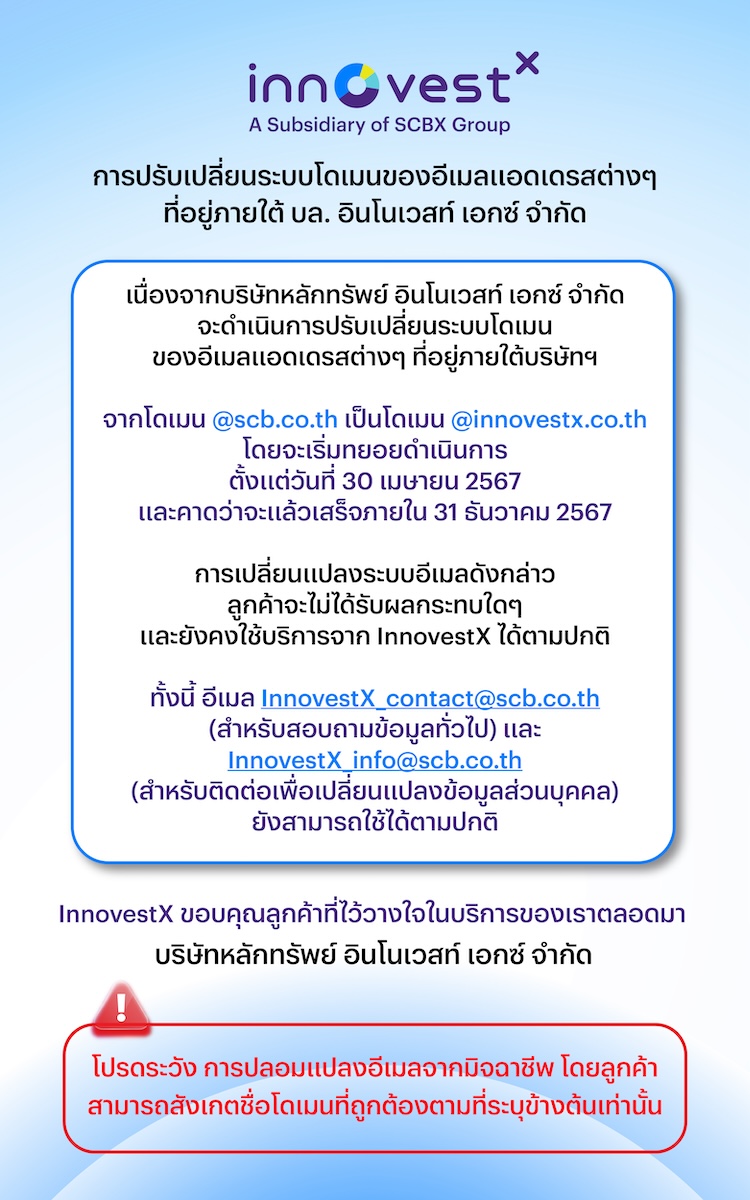

ประกาศสำคัญจากทางบริษัท

25 เมษายน 2567 รายชื่อหลักทรัพย์ที่บริษัทกำหนดให้ลูกค้าต้องวางเงินสดล่วงหน้าก่อนซื้อหลักทรัพย์ (บัญชี Cash Balance)

19 เมษายน 2567

10 เมษายน 2567 รายชื่อหลักทรัพย์ที่บริษัทกำหนดให้ลูกค้าต้องวางเงินสดล่วงหน้าก่อนซื้อหลักทรัพย์ (บัญชี Cash Balance)

04 เมษายน 2567

01 เมษายน 2567 รายชื่อหลักทรัพย์จดทะเบียนที่อนุญาตให้ลูกค้าซื้อหรือนำมาเป็นหลักประกันในบัญชี Credit Balance และอัตรา Initial Margin

29 มีนาคม 2567

ผู้ลงทุนควรทำความเข้าใจลักษณะสินค้า เงื่อนไขผลตอบแทน และความเสี่ยง ก่อนตัดสินใจลงทุน

.jpg?sfvrsn=60fd69aa_1)

.jpg?sfvrsn=48043fd5_1)

.jpg?sfvrsn=df007895_1)

.jpg?sfvrsn=6491565a_1)

.jpg?sfvrsn=c969d49_1)

.jpg?sfvrsn=aa8f9e8f_1)

.jpg?sfvrsn=eec96d77_1)

.png?sfvrsn=74b23e61_1)